I have recently cleaned out smaller holdings, as well as those holdings that didn’t meet certain quantitative metrics, but some holdings deserved a bit of a deeper look.

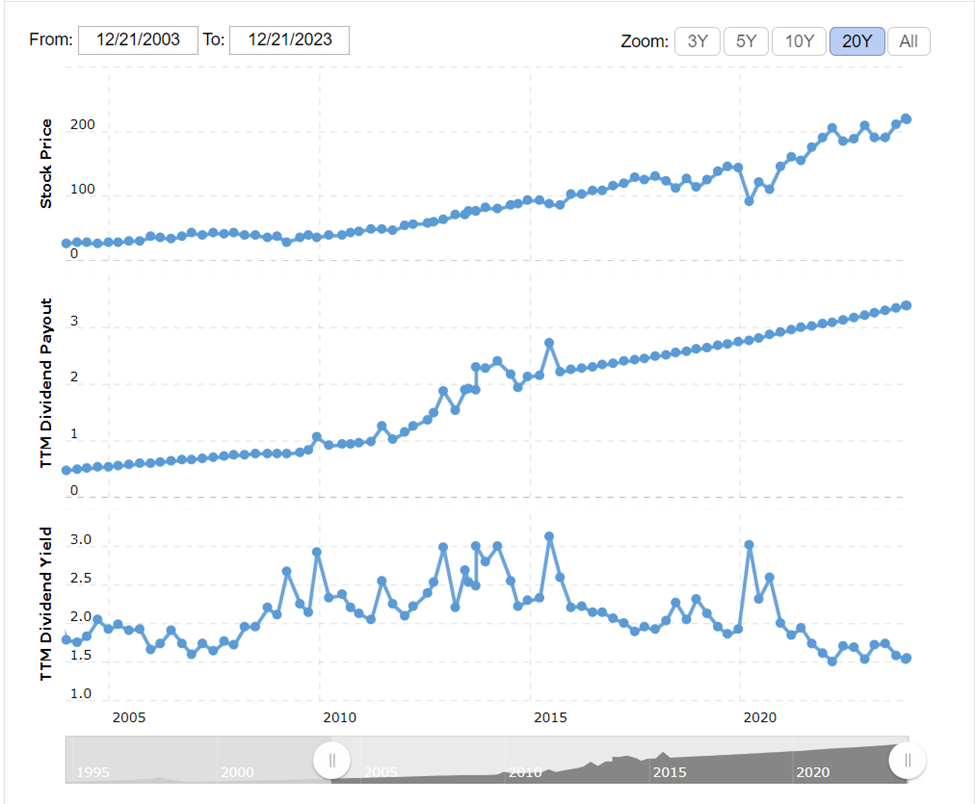

Chubb

Chubb Limited (CB) dividend payments per share are an average of 3.68% over the past 12 months, 3.37% over the past 36 months, 3.25% over the past 60 months, and 5.39% over the past 120

https://www.koyfin.com/company/cb/dividends/

A low yield and a low growth rate seems the norm for Chubb, however, I am going to retain this position. Chubb is the largest P&C Insurance Company and something I want to hold for the foreseeable future as long as they don’t cut their dividend.

MGRC

The company has only increased it’s dividend 6% in the past 5 years, and I don’t feel that same desire to keep it like I do Chubb so this is a sale.

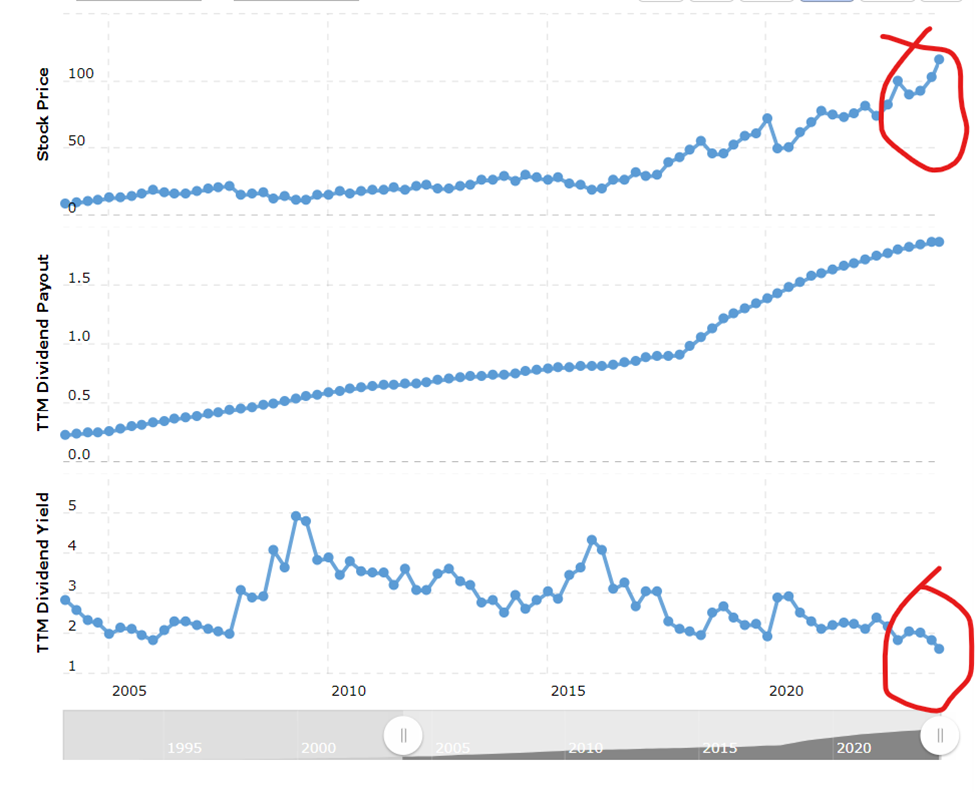

CSL

I believe the yield will eventually catch up to the 100% increase in the stock price rather than the stock price decreasing to the yield. This is a keeper for me.

PH

Parker-Hannifin Corporation (PH) dividend payments per share are an average of 19.07% over the past 12 months, 16.88% over the past 36 months, 14.63% over the past 60 months, and 12.44% over the past 120 months.

https://www.koyfin.com/company/ph/dividends/

Despite the current low yield I believe that they will continue to grow it at a high rate to eventually catch up.

CARR & OTIS

Carr and OTIS were a spin off of UTX. Both are low yield and only have 2 years of growth due to that spin off. However, they are growing them quickly.

Carrier Global Corporation (CARR) dividend payments per share are an average of 23.33% over the past 12 months and 66.61% over the past 36 months

https://www.koyfin.com/company/carr/dividends

Otis Worldwide Corporation (OTIS) dividend payments per share are an average of 18.87% over the past 12 months and 46.59% over the past 36 months

https://www.koyfin.com/company/otis/dividends/

CHRW

I am going to sell this position – the yield is too low and growth isn’t there.

C.H. Robinson Worldwide, Inc. (CHRW) dividend payments per share are an average of 10.91% over the past 12 months, 6.15% over the past 36 months, 5.81% over the past 60 months, and 5.71% over the past 120 months.

https://www.koyfin.com/company/CHRW/dividends/

MS

I received this stock during a merger or take over (not sure which one). They have 10 years of dividend growth but we are at an all time high for payout ratio. Going to sell this one.