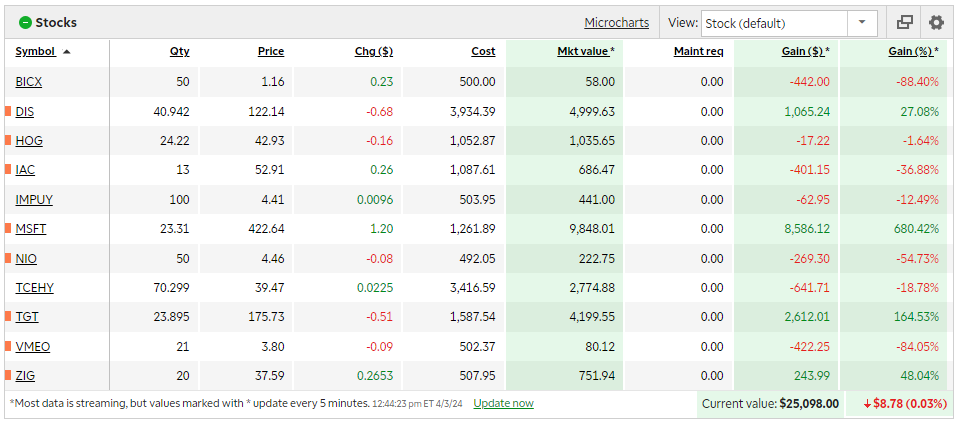

One of my goals this year is to review my small traditional IRA, and now is as good of a time as any. My Traditional IRA was a mixture of holdings that were either the next “tip” or companies that caught my attention at one point or another. The reason I have the holding is now irrelevant in April of 2024. The only choices I am going to make today are KEEP or SELL and why.

My Current Holdings

- BICX – This was a play that I jumped on, even though I hate biotech investments. I don’t understand what I am buying, and they all have amazing stories. Yes, we are going to cure addicition – f yeah let’s invest. This is a sale.

- DIS – They are in the middle of a proxy war but it is freaking Disney. I am good letting this one ride for as long as I can. Keeper.

- HOG – I bought this stock years and years ago. My thought was that it was just an iconic brand that people tattoo on their body so it’ll work out the problems it has. Of course, I am simplyifing my thought process, but in the 6 years I have owned the stock I am still flat (with dividend reinvestments). I am done with this ride (pun intended) – This is a sale.

- IAC – I have a buddy that works at IAC, and I loved “the story.” They would buy websites and internet companies, build them up and spin them off (VMEO below is one such holding). It is a really interesting company that either strikes out or hits home runs. For now, I am going to keep this holding.

- IMPUY – I didn’t even realize that I held IMPUY in this account (I have it one other as well). IMPUY is a platinum holding company. I am going to sell both positions.

- MSFT – Love this holding! 6x! An absolute Keeper.

- NIO – this is a Chinese EV car company. They differ from Tesla because they have invested and worked in the battery swapping strategy. They seem to be expanding. I am going to let this lottery ticket run – keep.

- TGT – Absolute KEEPER.

- TCEHY – this ADR is a Chinese conglomerate that seems to own a piece of every market in china from video games to cars (though BYD) to chat and payments. Another Chinese lottery ticket I’ll keep.

- VMEO – Vimeo spin off from IAC. I know nothing about it, and it is TINY holding so I am just going to get rid of it.

- ZIG – this is an ETF ran by an author, Tobias Carlisle, that I like. I am going ot keep this holding with my faith in him.

Future of the Account

I am not looking to actively manage this account so I am going to take the “cleared” $1,500 or so and stick it in an S&P low cost index fund. My plan is that whenever a stock comes up that I want to buy in the account, I will have to balance it against selling the S&P.

Show Comments