A few weeks back I wrote about about buddy talking to me about his newly found investment strategy using a weekly paying ETF and selling covered calls against it. Given the illiquidity of the option market on $ULTY and the lack of implied volatility (those things may be related) he basically was holding a callable bond. Meaning that he would receive his coupon (i.e. weekly dividend – which is juicy) and then at any time a ton of his shares would be called out from underneath him. Which happened since I wrote that post. I think he is waiting for a slight dip in the underlying ETF and will start over.

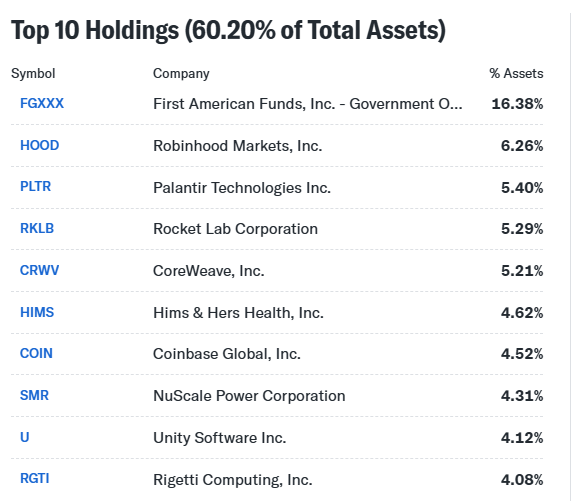

While I loved the strategy I ultimately couldn’t get behind it because I didn’t have much faith in the holdings of that particular ETF. Specifically, I didn’t get a great feeling about the underlying companies that make up the ETF:

I am j ust not running out and putting money into them (although I should with some of those names!). So it felt uncomfortable to base an entire strategy around them. But I still really liked the idea.

While I was mulling it over I received an email from a newsletter I follow about the monthly update for the Dividend Champion list. So I screened that list for:

- Pulled up every company with increasing dividends of 5yr+ (686 of them),

- took out any company that pays less than 4 times a year,

- then removed yields below 4%,

- then payout ratios above 80% ,

- TTM PE above 20

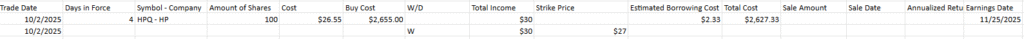

Ended up with like 20 or so companies. I then quickly saw which had weekly options. In the end I bought 100 Shares of HPQ and will continue to sell just out of the money calls until it is called away.

I am also tracking the trade, including the debt taken on.

I know this isn’t the end of the strategy for me. I think once I pay down some of the margin debt (should happen somtime in November) and I get back into straight investing within this account I am going to incorporate the buy-write for my monthly screens.