Last month while I was away I wrote a post about reinvigorating my financial goal which is simply put to create enough tangible income so that principal doesn’t have to be invaded during retirement. I have said about a thousand times that my favorite asset is my non-qualified dividend account. Within that account I sell naked puts (risky) to raise cash to buy my future income (safe). Notwithstanding, as of late, I have been selling naked puts (risky) to pay down debt quicker (safe).

So what does this have to do with anything? A friend of mine came to me with an investment idea that I sort of love and sort of hate at the same time. I am going to use this post to force myself to process idea enough to alter it into a love.

So what’s his plan?

If you understand basic options the strategy is relatively simple. He is buying an ETF with a ticker ULTY which according to the sponsor’s site,

ULTY is an actively managed ETF that seeks to generate weekly income from a portfolio of covered call strategies, each on a U.S. listed security (each an “Underlying Security” and collectively, the “Underlying Securities”).

So the underlying funds are trading covered calls, and then sells covered calls on the holding.

So let’s take today’s example

- ULTY is trading at $5.65 as of this post

- It is paying out $.09/share per week

So if we buy 100 shares $565 – we are receiving $9/week or $36/month. In his example he then sold the January $4 call which at today’s price will have a $165 premium. So, come January he will have received:

- $36*4 (Oct, Nov, Dec, and Jan) = $144

- $165 in Premiums

If the etf stays above $4 then he will receive $709 ($144+$165+$400). Profit of $309 inside 5 months. If the etf drops under $4 he’ll have $309 but his holdings will be worth $165+ less.

He is doing a few other things such as reinvesting and adding more and more contracts.

What I Didn’t Like

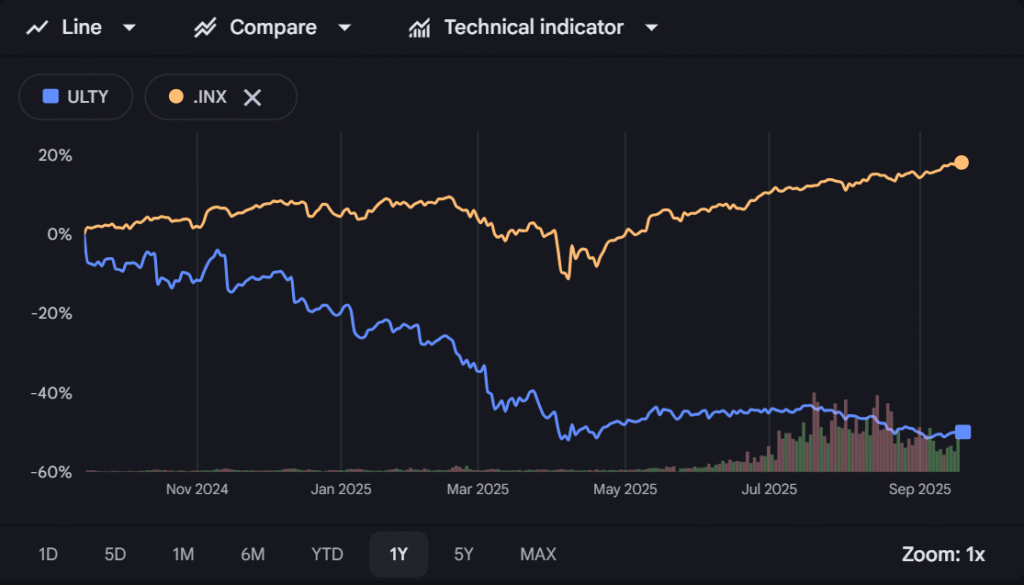

I immediately took a look at the chart and something didn’t smell right.

Why didn’t it pop back up after April’s drop from Trump? That’s when I found it.

My Research

It used to do synthetic trading so they didn’t own the underlying shares for the ride back up. Which lead me to the idea that I want the ETF to own the underlying shares rather than synthetically creating it. This led me to looking into the actual holdings of ULTY and that’s where I got stopped. The underlying assets were equities I wouldn’t normally buy (not necessarily bad, just not for me). So, if I don’t like the underlying assets why would I go forward with the design?

Altering the Idea

I am not in the midst of a nauseating search where letters are starting to get jumbled. I am looking for:

- an ETF that pays out weekly or monthly

- A healthy or healthy-ish options market.

- Holdings I can get behind

Think I found one option in JEPI! The problem I have is that it costs $5k+ for the first contract. I really really like the idea. I think It is something I may dive deeper into once I have some debt paid off!