A major goal long term goal that I have is to create a dependable long term income stream based on dividends. Does that mean it is guaranteed? Of course not, but neither is one’s salary, business profits, or rental income. Notwithstanding, I have created helped enough financial plans with a focus on retirement to know the power of an inflation adjusted stream of income during retirement, and since I don’t see a government backed pension anytime in my future this account is a major goal of mine.

Around the 15th of each month, I am going to run the below screen to provide me with a small “watch list.” I will then purchase between $500 to $1,000 every month of those companies.

Main Screen – Dividend Stocks with 20+ Years of Dividend Growth

First and foremost, I want companies that have dividend growth in their DNA. As such, I use the Dividend Champion (25+yrs) and part of the Dividend Contenders List (20+ Years).

While the number will change month to month it should be unusually stable as companies don’t often drop off (and to get on they would have had to started while Bush was President, and survived the dot.com bubble, 2007 – 2009 and the first phase of COVID).

This provides me with 167 companies that have increased their dividend for the past 20 years (last month it was 165).

Metric Screens

Once I have those companies I can screen them for particular metrics. Please review my larger discussion on screening for undervalued dividend growth stocks for definitions and thoughts on each:

- Company has to have a P/E under 20;

- A Dividend Yield of over 2%;

- Payout Ratio under 50%; and

- Positive EPS Growth for the past 5 years.

On December 14, 2020 these two indpendent screens provided me with me over 250 stocks that need to be cross-referenced.

Combining the Two Screens to Create a Watch List

I am left with the following companies:

| AFLAC Inc. | AFL |

| Arrow Financial Corp. | AROW |

| BancFirst Corp. OK | BANF |

| Cincinnati Financial | CINF |

| Community Trust Banc. | CTBI |

| Enterprise Bancorp Inc. | EBTC |

| First of Long Island Corp. | FLIC |

| General Dynamics | GD |

| McGrath Rentcorp | MGRC |

| MDU Resources | MDU |

| 1st Source Corp. | SRCE |

| J.M. Smucker Co. | SJM |

| Prosperity Bancshares | PB |

| Republic Bancorp KY | RBCAA |

| Cambridge Bancorp | CATC |

| T. Rowe Price Group | TROW |

| Tompkins Financial Corp. | TMP |

| First Financial Corp. | THFF |

| Telephone & Data Sys. | TDS |

As was the case last month, I don’t have a particular appetite for banks, financial companies and insurance companies. I just don’t know if we have a second resurgence of COVID what that may do to those 3 industries in particular. This leaves me with:

- General Dynamics

- McGrath Rental Corp

- MDU Resources Group

- JM Smucker

- Telephone & Data Sys

To finish up 2020 I am going to add to my positions in GD, MGRC and SJM.

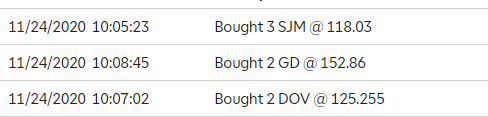

My November 2020 Purchases

After the same screen done above I was left with 23 companies which I narrowed down to:

- GD

- SJM

- DOV

- TDS

I ended up with the following tiny purchases: