My favorite part of my financial empire, is my dividend growth account. The idea that I could turn on a passive income sometime in the future without needing to interact with others just brings a smile to my face.

I am not naive I am well aware that possibility is at least a decade away (maybe more), but the best time to plant a tree was yesterday, and the second-best time is today. In the past, I have blown the account up using short puts (which I am still doing but have learned some very real lessons), as well as using the account for a few bigger purchases. With nothing on the horizon, I don’t see another invasion any time soon.

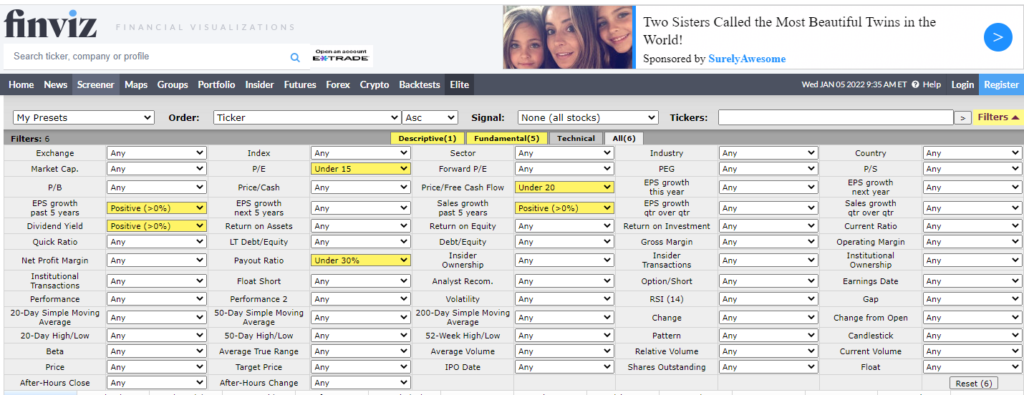

2022 Dividend Growth Screen

In January I gave myself the following parameters for 2022:

- The company must have increased their divdiend at least 15 years; and

- Price to Earnings under 15; and

- Price to Free Cash Flow under 20; and

- Earnings per share positive for past 5 years; and

- Sales growth positive for past 5 years; and

- Payout Ratio under 30%

Quarter 2 Dividend Growth Undervalued Screen Results

After cross-referencing the 250 or so of those companies with a dividend growth history of 15+ years with the above screen I was left with the following companies:

- AROW Arrow Financial Corporation Financial Banks – Regional

- BHB Bar Harbor Bankshares Financial Banks – Regional

- BMRC Bank of Marin Bancorp Financial Banks – Regional

- CTBI Community Trust Bancorp, Inc. Financial Banks – Regional

- FLIC The First of Long Island Corporation Financial Banks – Regional

- MCY Mercury General Corporation Financial Insurance – Property & Casualty

- NWFL Norwood Financial Corp. Financial Banks – Regional

- PB Prosperity Bancshares, Inc. Financial Banks – Regional

- SBSI Southside Bancshares, Inc. Financial Banks – Regional

- TMP Tompkins Financial Corporation Financial Banks – Regional

- XOM Exxon Mobil Corporation Energy Oil & Gas Integrated

Those companies I have bolded are positions that have been opened. My goal until the next screen is to build the smaller ones (AROW, MCY and NWFL).