My favorite part of my financial empire, by a long shot, is my dividend growth account. The idea that I could turn on a a passive income sometime in the future just brings a smile to my face. I know that possibility of passive income would be at least a decade away, but the best time to plant a tree was yesterday, and the second best time is today. In the past I have blown the account up using short puts (which I am still doing but have learned some very real lessons), as well as using the account for a few bigger purchases. With nothing on the horozin (but a real estate deal could always show up), I don’t see another invasion any time soon.

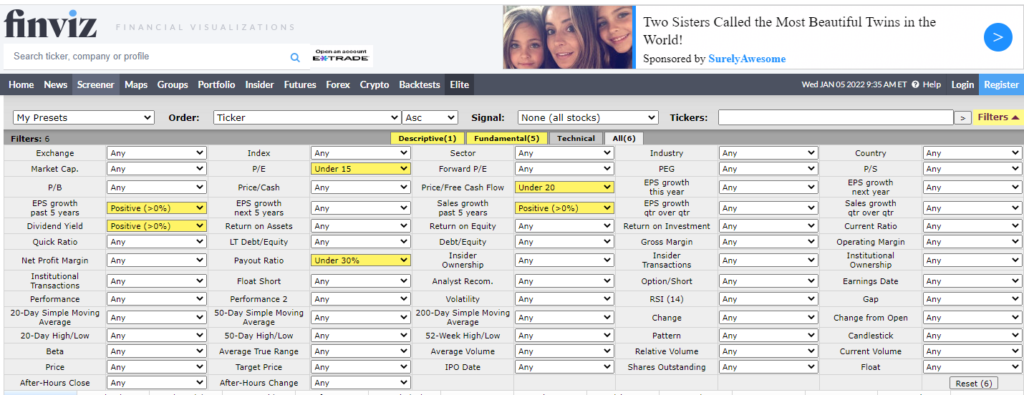

2022 Dividend Growth Screen

I have decided for 2022 I am going to increase the number of dividend growth companies by reducing the company’s required growth history from 20 down to 15. However at the same time, I am going to tighten down my “margin of safety.” Specifically my 2022 screen will be:

- Price to Earnings under 15; and

- Price to Free Cash Flow under 20; and

- Earnings per share positive for past 5 years; and

- Sales growth positive for past 5 years; and

- Payout Ratio under 30%

Dividend Purchase Strategy

Connected with my short put strategy better outlined below, my goal is to make some type of purchase every week (Friday/Following Monday). The amount of the purchase will be based on the amount of income cleared for that week (income discussed below). Always will come in a bit lower to allow cash to continue to accumulate.

There are three types of purchases:

- Dividend ETF – I don’t have all the answers and believe that I could benefit from a professional. This year going to try and fund a position in the Vanguard Dividend Appreciate ETF (VIG). A low cost, passively managed, etf that tracks the Dividend Growers Index.

- Screened Individual Companies – Using the screen above I will continue to add to individual positions.

- Pure Bets – Every so often I take pure bets, usually using out of the money call options. For example, I bought Ford Calls when it was trading at $12 that it would hit $20 by 1/2023. The cost of the trade was $73 and is now worth $675. On the other end of the spectrum if a buddy likes a certain stock I’ll buy out OTM calls on it to have some skin in the game – those almost always lose money…except when they don’t.

Which I choose weekly, and their eventual result will be tracked going forward.

Selling Short Puts to Fund the Account

I have been selling naked puts for years. I wrote last year,

A put is a type of options contract where, in the simplest terms, one party can force another to take on the stock of a company at a predetermined price. There are plenty of other resources on the interwebs about the definitions of different options contracts, and since I am pretty sure I am talking to myself at this point, I am not going too much deeper than that.

The strategy I am most obsessed with is selling out of the money (OTM) naked puts wherein I take the risk that some of the largest companies in America are not going to drop 10%, 15%, or even 20% from where they are. For that bet I am paid a small premium (the pennies in front of the steamroller). Those times where just one stock gets put to me it isn’t a huge deal because I then just hold the stock and sell covered calls against the position until it is assigned. The problem is when everything shits the bed (see above). The strategy I am employing is “naked” in nature where I have no downside protection most of the time.

My favorite type is when a stock drops after an earnings call.

In that post, I wrote about setting up a spreadsheet and trying to go for a $25/day goal. I have since played around with the spreadsheet refining it a few times, but I hit a $30/day goal in 2021. For 2022 my goal is to keep the $30/day goal at least for the first quarter. I will reassess at that point.

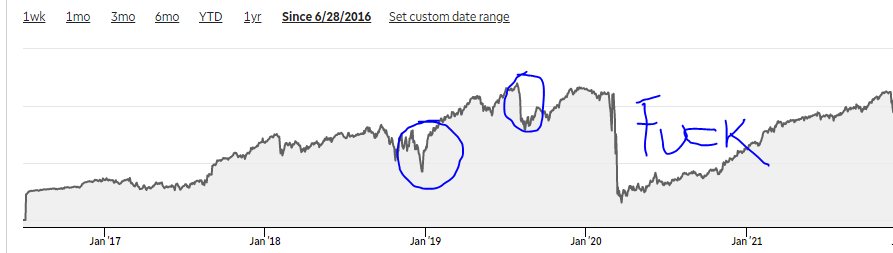

I have blown up the account on 3 different occasions, all of which have taught me something.

- First time was late 2018 – the lesson I flew too close to the sun. I didn’t leave myself ANY room for a maintenance call. So that was a terrible wake up call.

- Second time was mid 2019 when I withdrew money to purchase our new home without unwinding from some of the longer trades I had. This made me realize that this account has to be in its own silo, only to be invaded in the most dire of circumstances.

- COVID-19! Like the rest of the world I got decimiated. It wasn’t that I did anything wrong on the investment side of it, but I went head in the sand ostrich style. Well, I learned that when your broker says jump to fix your maintenance balance your only responses are how high and how quick! TD Ameritrade exited me out of positions that completely came back! A couple of grand in pushing out my contracts and my account with be at least 50% higher than where it is today.

For 2022 I am going to try and continue my $30/day goal for at least the first 1 to 2 quarters. However, as indicated above, the difference this year is that I am going to try and make a weekly purchase with most not all of the proceeds that were cleared that week. I am well aware that not every week can be profitable so there will be missed weeks.

Conclusion

In addition to the above, I want to take a look at this account quarterly to take stock of where I have been, and where I have to go. To say I am excited about this account for 2022 would be an understatement! I really want to grow this account to be a larger and larger portion of my net worth, and eventually income.