I don’t have an elaborate formula to determine how much cash I should keep outside of brokerage accounts. Currently, I keep $20,000.00 because, to me, that amount represents the most I am going to need in an “oh shit” moment. I would probably keep more if I didn’t have a steady job (been with the same employer for 14 years), or a steady law practice outside of that job. In addition, I don’t know how much The Wife and I spend monthly so I can’t do a multiple of expenses.

However, in the past 2 or 3 months, I have spent way more time thinking about this account than I’d to admit, and the reason is because of rampant inefficiency which absolutely kills me.

Cash vs Paying Down my HELOC

My emergency fund is sitting in a Capital One Account which used to be known as a “high yield savings account.” Currently, that account is paying me .30%! LESS THAN ONE FREAKING PERCENT.

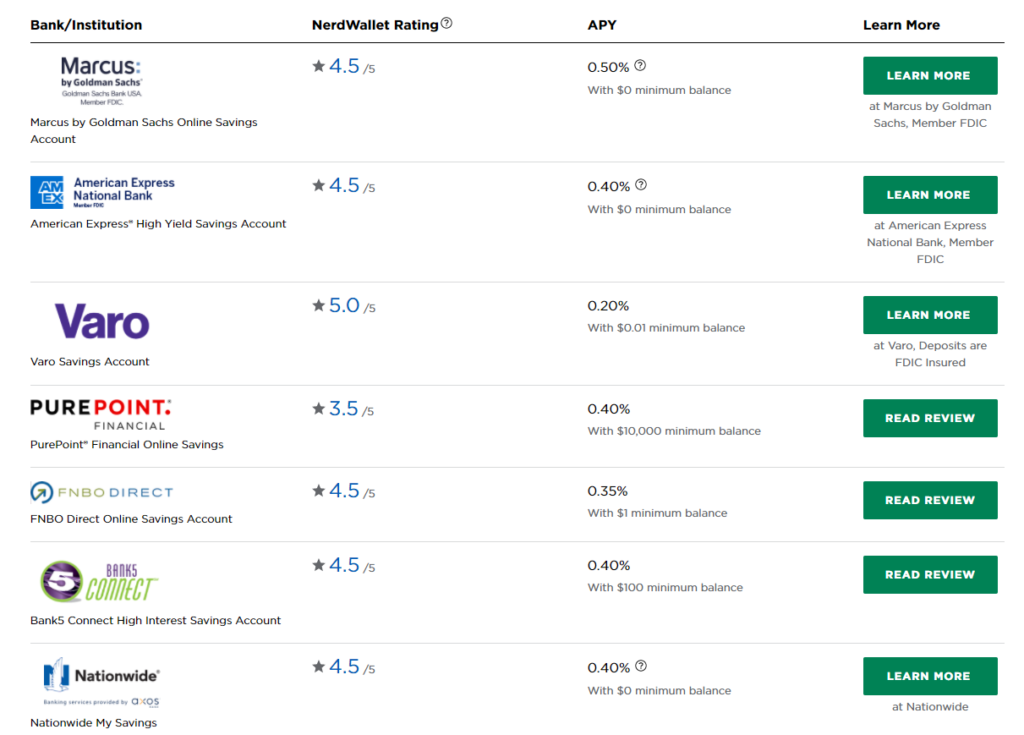

A quick search on NerdWallet shows that this is basically in line with the market:

Again, given that I feel pretty secure with my employment, there has to be a better fucking use of money than .3%! That’s like $5 a month in interest. Notwithstanding, given that this is supposed to be safe money I am not willing to throw the funds at an investment account, and then it hit me – THE HELOC ON MY RENTAL PROPERTY!

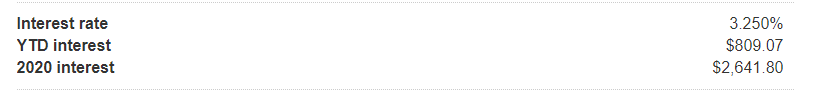

Way before I created this site, and I was writing on my original site, I chronicled the process of obtaining a HELOC on my old home. The reason we originally took it out was to capitalize The Wife’s business, it then became a huge part of how I financed the new home purchase. Specifically, when we didn’t sell the home I had to turn to it for a quick influx of cash to be able to close on our new home (Aug 2019). Since then it kind of just sits there with me throwing a couple of hundred dollars at it a month (the approximate excess on rental income minus the regular mortgage payment plus a few bucks extra). It is a floating interest rate that is currently at 3.25% but pre-pandemic it was near 5%! The current balance is around $59k.

Using the HELOC as a Mini Emergency Fund

So the plan is to take $15k of cash and “loan” it to the HELOC until I really need it (which is hopefully never). This will bring my monthly approximate interest payment from $160 (($59,000* 3.25%))/12) to $119/o (($44,000*3.25%/12)).

Granted it only swings $40/mo in the positive cash flow direction my way, but there is the bigger benefit of compounding that out months or year, especially as I try to really pay down this debt. I believe that at some point in the next year or two interest rates will increase because they are going to have to do something to combat inflation. The bank that holds this loan has already shown they are very comfortable increasing my rate at will, and so when that happens that $40 spread is going to get bigger, as is the benefit for whatever I pay down today vs. later.

Since it crossed my mind I should address about putting the money in the market. I quickly decided against this idea, because if I need it, the cash may not be there because of market losses or large capital gains creating an efficiency problem I am trying to currently fix. I also thought about throwing it at my new life insurance loan but decided against that because that feels a bit more transient in nature. I have less faith in that institution vs the bank that holds the loan, so I can’t guarantee that if/when I need the money the credit line will be there.

The only downside risk I can think of here is that we enter a credit crunch situation similar to 2008, but in today’s world it just seems so unlikely that I am comfortable with that risk. I am going to implement this plan after refinancing, so hopefully late May or early June (application is already in and I don’t want to spook the bank).