I know it is cliche, and I am positive I have written it before but this year is flying. I think it is because I have been so freaking busy between work, my law practice, and children activities. All good things just feels weird to lift my head up and remind myself I have to write this post for November of 2021!

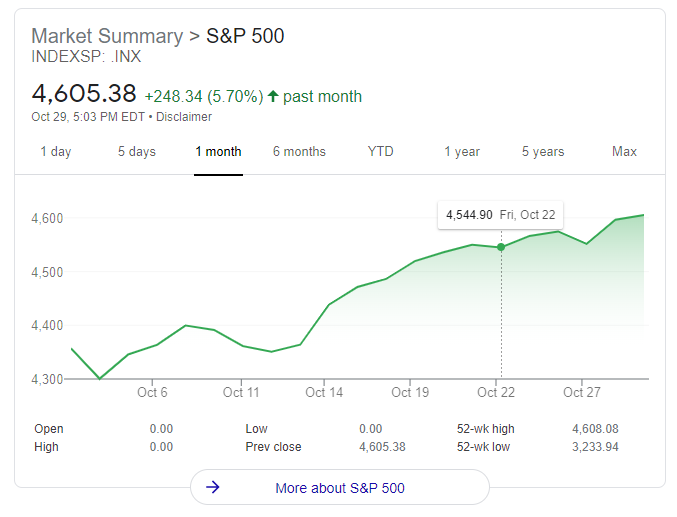

Thoughts before Calculating: I am highly correlated to the market, so given that the market was up over 5% month over month, I am thinking it will be a pretty good month. The family and I did travel so there was an absolute increase in spending, but I can’t imagine that was enough to take a bite into natural market movement.

Calculating my Net Worth

My Family’s Assets

I will be writing an introductory post about most of the assets below, and update them whenever it seems appropriate.

- Cash Equivalents – I finally got this number to a comfortable number! It represents about 2 months of my family’s bare minimum run rate. It is also is probably the largest, “oh shit” number I would need access to within a day or two*.

- My Trading Account – This one account is both where I invest in my dividend growth companies and risky speculative option trades.

- My 401(k) – My 401(k) has some terrible investment options that have ridiculous fees, but since I am getting a match at work I fund it to a little bit above the match. Last month I wrote, “this was down hard this month“ and now it is way up! This is probably the largest reason I am so correlated to the market.

- My Traditional IRA – Just some companies that have caught my attention at some point or another.

- The Wife’s Roth IRA – Again, some companies that have caught my attention at some point or another.

- The Wife’s SEP IRA – Brand new account. The Wife was talking to my father in law who told her that she should have a SEP IRA, and since she is funding it with business proceeds, I was not going to argue. Just going to be sending $100/week to the account. Plan is to just buy a broad based equity ETF (VOO) and a smaller position in a dividend-focused ETF (NOBL).

- Crypto Currency – A handful of years ago during the height of the first crypto-mania I decided to put a few dollars into BitCoin (literally it was just $1k).

It felt like immediately after I made the transfer BTC took a nosedive. At that point, I made the decision just to ignore the account – and it is just back to above even. Upon talking to a buddy about Bitcoin and actually signing into my account for the first time in months/possibly a year, I found out that CoinBase allowed for periodic investments, so I turned them on. I did just $50 a month, figured it was an amount that if the whole thing crashes I am not going to be too pissed, and if it takes off, then at least I’ll have a taste. - Life Insurance Cash Surrender Value – As described I own a number of permanent, cash value whole life insurance policies. Since the cash is accessible I include it in my net worth statement. This money is also accessible via a loan against the cash value. These values now have a loan against the cash.

- Physical Gold – A few years back I decided to start buying physical gold, I am hoping one day to be that crazy guy with a stack of gold I can swim through.

- My Rental Property – Every month I update a spreadsheet I keep for the minority owners of my rental property.

- My Main Residence – My Family’s home!

Currently, I do not include my investment clubs in my net worth.

* A few months back I wrote about how I want to use my cash a bit differently. Specifically, I am sitting on my emergency fund paying me a disgusting .30% while I am paying over 3% on my HELOC. I have decided to start moving over about half of my EF into my HELOC to lower my monthly interest costs. I plan on keeping it a line item as an “interest-free loan” to my rental asset.

My Family’s Debt

- Law School Debt – Just refinanced at 2.6%, probably going to ignore the account for a while.

- Mortgage and Home Debt – I have a mortgage on each home and a home equity line of credit on the rental property.

- Revolving Credit Card Debt –

Carry a small balance which I will probably get rid of this month or next month when the refinance goes through. Damn it, last month I wrote, “for the first time, in a long time, I can say I have zero credit card debt” it’s back.

My Net Worth Change

- Month over month my net worth increased 4.42%.

- Since starting AA my net worth has increased by approximately $156,300.