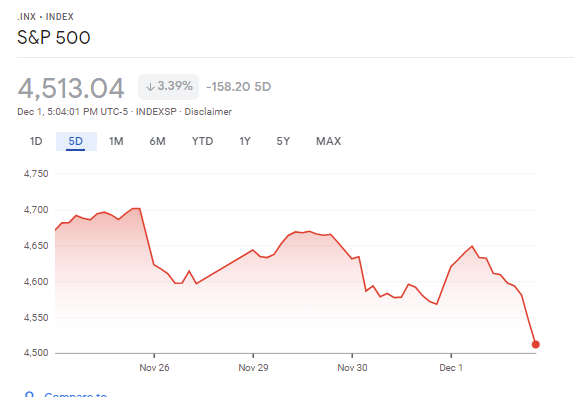

To say I am not looking forward to calculating my net worth this month, would be a complete and utter understatement. I haven’t felt this type of dread since February 2020, and it is shocking to me (maybe not others) that it is for the same fucking reason…covid. Two or three days ago news came out about the “omicron strand” of the virus and it sent the markets into a complete shit storm:

Look at those 5day and 1m charts! Oooooofa. However, if we zoom out a bit more! it brings us basically back to Octoberish.

As I continue to be more and more correlated to the market I think this highlights a problem with a monthly scorecard.

Thoughts before calculating: Between the shit market, we went away to Nashville to celebrate my 40th, so my guess is that is going to be nasty, Always fun when you start to calcuate is when you find a “Maintenance Call” on my dividend growth/naked short put account which has once again put my risk tolerance in question. That will be tomorrow’s problem to fix (literally tomorrow).

Calculating my Net Worth

My Family’s Assets

I will be writing an introductory post about most of the assets below, and update them whenever it seems appropriate.

- Cash Equivalents –

I finally got this number to a comfortable number! It represents about 2 months of my family’s bare minimum run rate. It is also is probably the largest, “oh shit” number I would need access to within a day or two*.Earlier this year I wrote a post about moving a good amount of this month towards my rental property’s HELOC. I did that with 40%, utilizing amount 10% to pad my main checking account. We’ll see how this looks going forward. - My Trading Account – This one account is both where I invest in my dividend growth companies and risky speculative option trades. This is going to need some attention over the next 5 to 7 days!

- My 401(k) – My 401(k) has some terrible investment options that have ridiculous fees, but since I am getting a match at work I fund it to a little bit above the match. Two months ago I wrote, “this was down hard this month“ and then last month I wrote, “now it is way up!” This correlation to the market without any real control is both a struggle and also problely a MASSIVE benefit.

- My Traditional IRA – Just some companies that have caught my attention at some point or another.

- The Wife’s Roth IRA – Again, some companies that have caught my attention at some point or another.

- The Wife’s SEP IRA – Brand new account. The Wife was talking to my father in law who told her that she should have a SEP IRA, and since she is funding it with business proceeds, I was not going to argue. Just going to be sending $100/week to the account. Plan is to just buy a broad based equity ETF (VOO) and a smaller position in a dividend-focused ETF (NOBL).

- Crypto Currency – A handful of years ago during the height of the first crypto-mania I decided to put a few dollars into BitCoin (literally it was just $1k).

It felt like immediately after I made the transfer BTC took a nosedive. At that point, I made the decision just to ignore the account – and it is just back to above even. Upon talking to a buddy about Bitcoin and actually signing into my account for the first time in months/possibly a year, I found out that CoinBase allowed for periodic investments, so I turned them on. I did just $50 a month, figured it was an amount that if the whole thing crashes I am not going to be too pissed, and if it takes off, then at least I’ll have a taste. - Life Insurance Cash Surrender Value – As described I own a number of permanent, cash value whole life insurance policies. Since the cash is accessible I include it in my net worth statement. This money is also accessible via a loan against the cash value. These values now have a loan against the cash.

- Physical Gold – A few years back I decided to start buying physical gold, I am hoping one day to be that crazy guy with a stack of gold I can swim through.

- My Rental Property – Every month I update a spreadsheet I keep for the minority owners of my rental property.

- My Main Residence – My Family’s home!

Currently, I do not include my investment clubs in my net worth.

My Family’s Debt

- Law School Debt – Refinanced a few months back at 2.6%, probably going to ignore the account for a while.

- Mortgage and Home Debt – I have a mortgage on each home and a home equity line of credit on the rental property.

- Revolving Credit Card Debt –

Carry a small balance which I will probably get rid of this month or next month when the refinance goes through. Two months ago, I was able to write that I was debt free, and over the past two months debt creeped back into my life. I am pretty sure I’ll be able to most, if not all of it, with my bonus payment this year.

My Net Worth Change

- Month over month my net worth decreased 2.35% .

- Since starting AA my net worth has increased by approximately $140,000.

Fucking Ouch.