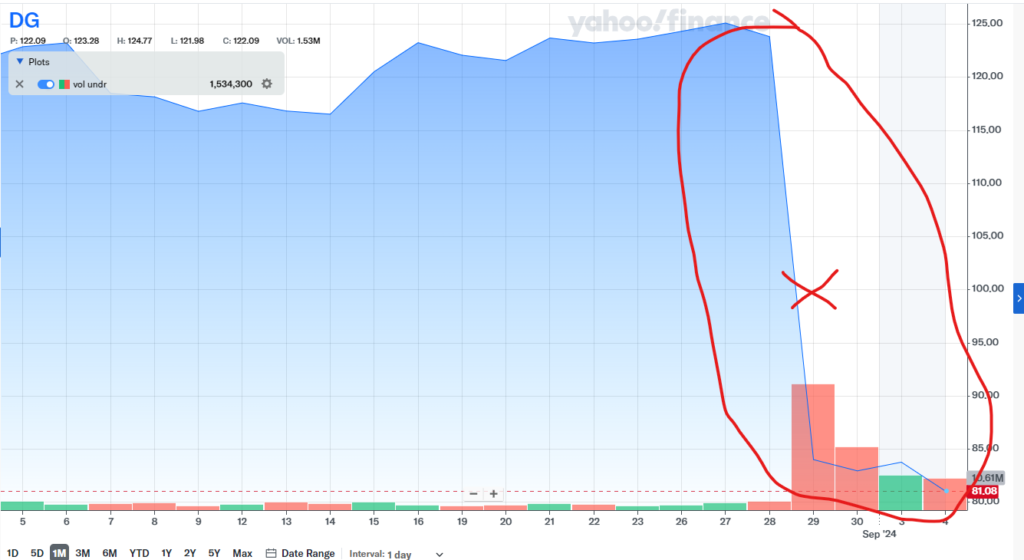

I had a rare missed calc in August. I was lucky enough to be away with my entire family on a cruise, and by the time I got back the market had a dip, and I had some extra debt so I wasn’t entirely excited about the prospect of putting it down on “paper.” Again, this month I found myself in the exact same situation. Debt is piling up and I was recently assigned 500 shares of Dollar General with another 2 outstanding contracts and 5 contracts of Dollar Tree that I am trying to manage.

DLTR looks very similar.

But then I thought to myself, that absolutely no one reads this site, so if I can’t be honest here and man up to look at my family’s spreadsheet I am doing something wrong….and if I am being honest with myself I did do something wrong. I set up guardrails for myself years ago to try and avoid these inevitable blow-ups (i.e. limit the carnage that happens every few years) when trading this particular style. I ignored those guard rails and now I am pissed at myself.

When I get out of this mess I will adjust accordingly.

Thoughts Before Updating my Spreadsheet: This is likely going to be a bad, bad month (see above).

Calculating my Net Worth

My Family’s Assets

While I have several asset categories, I don’t think they are particularly complicated.

- Cash Equivalents – A few months ago I calculated how much cash I would like to have on hand, and I am woefully short of that. This is going to be a massive grind to get me to my desired number, but I am up for it!

- My Trading Account – This one account is both where I invest in my dividend growth companies and risky speculative option trades. Early this year I decided how I am going to handle the account in 2024, which I then updated recently. This is the account I was talking about above! Unless there is a massive move, this is going to take a really, really long time to unwind from.

- My 401(k) – My 401(k) has some terrible investment options that have ridiculous fees, but I get a match so I have to participate. I recently increased my contributions, and I am hoping to do so one more time before the end of the year.

- My Traditional IRA – Just some companies that have caught my attention at some point or another.

I wrote last month, “I think in Q1 I’d like to take a more intentional approach to this account.” I failed in Q1, but I won’t fail in Q2.I reviewed and updated the account. - The Wife’s Roth IRA – Again, some companies that have caught my attention at some point or another.

I wrote last month, “I think in Q1 I’d like to take a more intentional approach to this account.” I failed in Q1, but I won’t fail in Q2.I reviewed and updated the account. - The Wife’s SEP IRA – The Wife was talking to my father in law a few years back who told her that she should have a SEP IRA, and since she is funding it with business proceeds, I was not going to argue. We were contributing $100/week to the account, but that has stopped since her business is really on the decline.

- Crypto Currency – This account was basically started for FOMO purposes. It is a shitty reason, but it is mine nonetheless. I don’t pay much attention to the crypto market and will probably continue to ignore the account.

- Life Insurance Cash Surrender Value – As described I own a number of permanent, cash value whole life insurance policies. Since the cash is accessible I include it in my net worth statement. This money is also accessible via a loan against the cash value. I have plenty of posts about paying it back and then pulling it back out and then paying it back. I don’t think I will start aggressively paying this one back until mid 2025, but we’ll see.

- Physical Gold – A few years back I decided to start buying physical gold, I am hoping one day to be that crazy guy with a stack of gold I can swim through. Two months ago I wrote, “I’d like to pick up my small purchases this month.” I failed, and I don’t see it happening till after the new year.

- My Rental Property – Every month I update a spreadsheet I keep for the minority owners of my rental property.

- My Main Residence – My Family’s home.

Currently, I do not include my investment club in my net worth.

My Family’s Debt

- Law School Debt –

Refinanced this to 2.6%, a year or so ago. I am aggressively paying this down this year (9% in January, another 10% in Feb and 9% in March) so I can clear out some more cash flow.Finally paid off. - Mortgage and Home Debt – I have a mortgage on each home.

- Consumer Credit Card Debt –

I keep going from zero to a shit ton and it is killing me. I am hoping to get rid of most of it, if not all of it in 2024 and get it entirely under control.I killed the 0% credit cards in March (helping out operation C.R.E.A.M), but my Amex got away from me so I put all of it on a 7% fixed and it will now need to be eliminated, aggressively, now that the law school debt has been retired.

My Net Worth Change

- Since I don’t have Month over Month from July to September my family’s net worth increased about 1%

- Year to date my family’s net worth increased by about 16%

Shockingly I am somehow up! I honestly can’t believe it.

Looking at my assets, three things kept me afloat despite my active attempt to fuck it up:

- Systematic and non-correlated increases in my real estate. For the past few years I have increased my two property’s value to try and get it a bit closer in line with the market. Instead of doing it in one shot I am doing annual increases of 3% calculated on a monthly basis. Nonetheless, I am still undervaluing the properties, but don’t want a massive jump.

- Similarly, those properties have amortizing debt structures (i.e. a mortgage lol).

- My 401(k) is just much larger than my trading account so despite my trading account getting destroyed by 401(k) was up for the month all but covering up those losses.

I really want to give some thoughts to Q4 this month.